Now a days, to manage working capital requirements, entrepreneurs are moving towards bank to raise funds at cheaper rate instead of investing their own funds. Banks are also interested in giving loans to businesses that have strong financial and repayment capacity. When we approach bank then they ask for Project report and CMA data of business, so that they can analyze the financial soundness of business. CMA Data is based on audited/Provisional/Projected Financial statement of the business. There are many points, we have to cover while preparing CMA Data of any enterprises like accurate financial figures, comparative Projected figures and ratio Analysis. In this article we will discuss “How to Prepare CMA Data for Bank Loan”

Documents that should be available with us, for preparing Project Report and CMA data are as follows:

Normally in CMA Data, we have to provide 5 Years comparative financial statements. 2 Years Audited, 1 Year Provisional and 2 Years Projections based on realistic data. In preparation of CMA Data, ratio analysis plays a vary vital role. The CMA Data must be prepared with due care. Loan application approval is mainly depended on these financial figures and ratios. Further, presentation of CMA data is little bit different in case of Manufacturing unit and trading unit. So, we need some additional inputs in case of Manufacturing units.

To present the Profit/ Loss statement, we have to prepare manufacturing account, Trading and Profit/ Loss statement which depicts comparative data of 5 years. In this statement, we have to give details related to Sales, Cost of sales (it includes details related to Raw material consumed, direct and indirect expenses related to manufacturing activities, cost of production, interest expenses incurred, bifurcation of operating and non-operating expenses, calculations of taxes to pay.

Preparation of Balance Sheet, includes comparative presentation of Fixed assets, Investments, current assets like Cash and bank balances, receivables and showing of current liabilities. All details should be provided in elaborated form like if receivable amount includes export related receivable, then we have to show receivable in 2 parts – export related receivables and other than export related receivables. While preparing CMA data, it is easy to get details of 3 years (2 Years audited and 1 year provisional).

We have to give adequate attention while preparing projected summary of next 2 years. While making projected financial statements, we have to keep in mind, the economic conditions, orders in hand, future government policies that may impact our business. And all projected figures must be in correlation with our past 3 years data. If any exceptional increase/decrease is made in any head then we must explain the same in our CMA data and project report. We have to explain our assumptions related to future forecast.

If we require funds to start new project, then we should describe that project related information in our project report. The main purpose of CMA data is ratio analysis. By presenting figures in comparative format, we have to present realistic figures before our investors/ banker by using ratio analysis. Mainly used ratio while preparing CMA Data is as below:

Note: Bankers generally compare, above ratios calculated by us, with standard benchmark ratios already available with them. If ratios are not in acceptable limit, then it may lead to rejection of your loan application. So, we must take care while classifying our financial figures in Profit/ Loss account and Balance Sheet like wrong classification of current asset as long-term investment impact our current ratio.

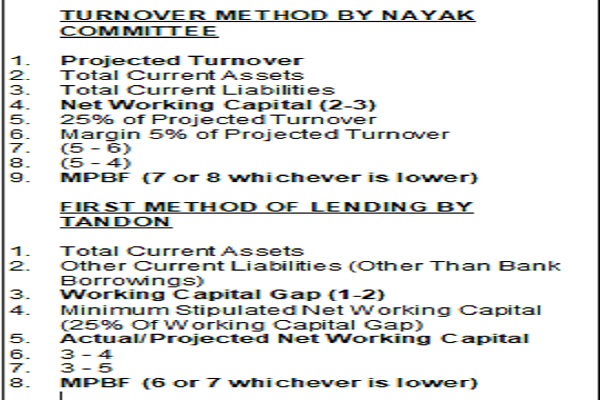

After analyzing financial figures, bankers normally use Nayak Committee Turnover Method/ Tandon lending method to finalize the loan sanction limit.

Along with these financial statements, we have to prepare fund flow statement, to show case how the funds will be raised and utilized.

Preparation of CMA data is very critical and time-consuming work. We have to consider many factors before preparing CMA Data. I have tried to give glimpse of points and documents that should be given attention while preparing CMA Data. Before submitting loan application and CMA data/ Project report with banker, you must ensure that you have prepared all documents with almost care and attention. As several rejection of loan application may impact your CIBIL report.

Disclaimer: This article is for the purpose of information and shall not be treated as solicitation in any manner and for any other purpose whatsoever. It shall not be used as legal opinion and not to be used for rendering any professional advice. This article is written on the basis of author’s personal experience and provision applicable as on date of writing of this article. Adequate attention has been given to avoid any clerical/arithmetical error, however; if it still persists kindly intimate us to avoid such error for the benefits of others readers.

The Author “CA. Shiv Kumar Sharma” can be reached at mail –[email protected] and Mobile/Whatsapp – 9911303737/ 9716118384